We are writing a series of Blogs to help Buyer’s of FM services understand the market and what they should expect from the market.

This Blog focuses on typical FM delivery models in the context below:

- The Market

- Typical FM Delivery Models

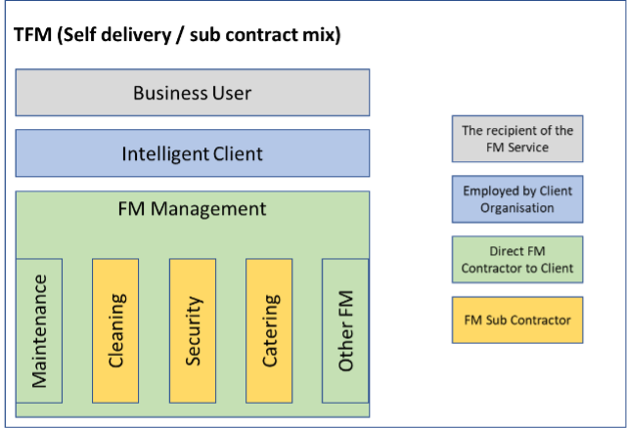

- TFM (Self delivery / sub contract mix)

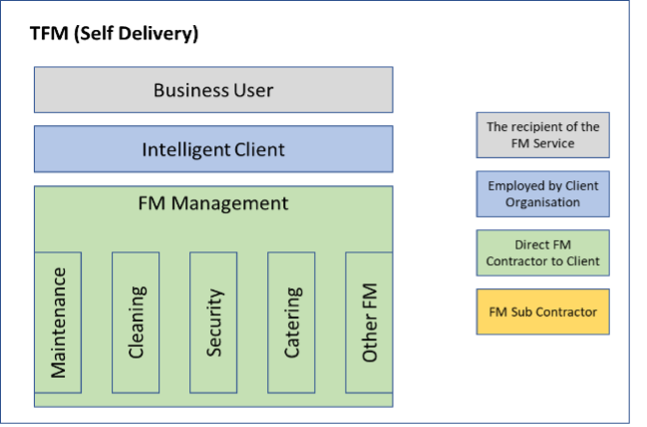

- TFM (Self Delivery)

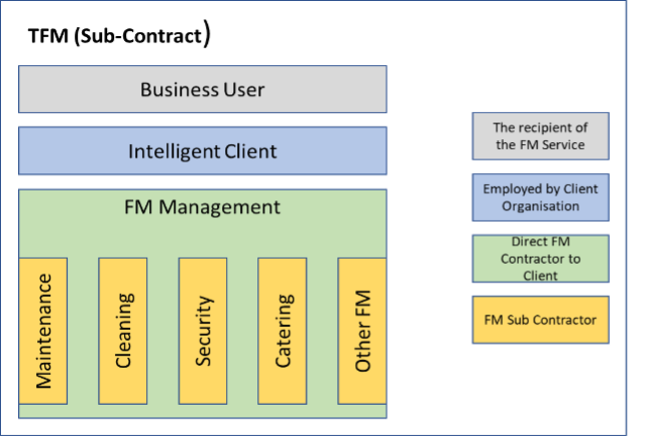

- TFM (Sub-Contract)

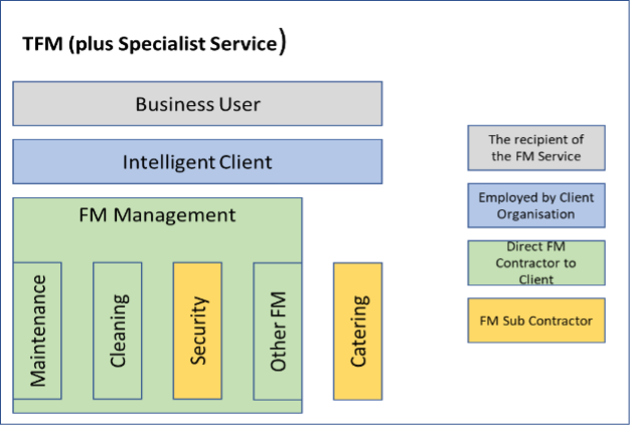

- TFM (plus Specialist Service)

- Managing agent / integrator model

- Management In-house single service or bundled outsourced delivery

- Management In-house, bundled / single service outsourced delivery

- In-house management and delivery

- Role of intelligent client

- Conclusion

Subsequent Blogs will include:

- What Buyers should consider when sourcing FM services.

- How the FM Market is evolving and what a Buyer should expect from an FM provider

The Market

The FM Provider Market includes substantial multinational, self-delivery companies to “fleet of foot” international management companies, “boutique” FM suppliers targeting specific markets within a country or even regions within a country.

With the right risk transfer and client engagement it is a capable market able to deliver a complex range of services. These range from high-volume labour-intensive services to specialist services that ensure organisations are compliant; these services enable clients to deliver core business objectives.

Typical FM Delivery Models

We have shown below some typical models that clients adopt. Nearly all of the suppliers in this paper offer TFM either by offering predominantly self-delivery or by sub-contracting some or all of the FM services. The broader the range of services and the greater the international geography of the portfolio the more likely that the TFM services will include some sub-contracting of major FM Services. Equally, a lot of the suppliers included will provide single FM services or bundled services as well as TFM. We have also included some suppliers that are large service delivery companies that tend to offer single services (eg cleaning) or bundled services and not TFM.

The following show a number of TFM models that typically a supplier may propose when FM services are tendered.

One of the most common TFM models delivered by the market includes a combination of self delivery and subcontract mix (See Figure 1 below). Historically suppliers evolved from a single service eg catering, maintenance etc. and as they have grown their facilities management capability, they have added other services. However, often suppliers either do not or cannot demonstrate a core competency in all service areas and across all geographies. This then leads to either strategic partnering with specialist suppliers or sub-contracting as client requirements develop. Typical organisations in this category would be CBRE, JLL, Sodexo.

Some companies in the market are seeking to develop a self delivery model of all FM services (See Figure 2). To achieve this they will need to restrict their offer to certain client types / geographies as this model is almost impossible to implement across a diverse global portfolio. Typical organisations in this category are Anabas and Salisbury and CloudFM. Some of the larger FM companies have hybrid models where they have strengths in self delivery in some locations but will supplement this with a sub-contracting strategy elsewhere such as CBRE, JLL ISS and Engie.

Equally other organisations focus on investing in the management and FM systems and developing relationships with suppliers to deliver the majority of the FM services through their supply chain. (See Figure 3). Typical organisations in this category are Mace Macro and Cushman & Wakefield. Those organisations who have a sub-contracting model are more suited to widely spread portfolios which may include both large and small properties.

Often clients may believe the market cannot support particular services effectively as part of a TFM offer and choose to separate out certain services even if all the other services are procured as part of a TFM model (See Figure 4). The most popular services provided outside of a TFM model include catering and security.

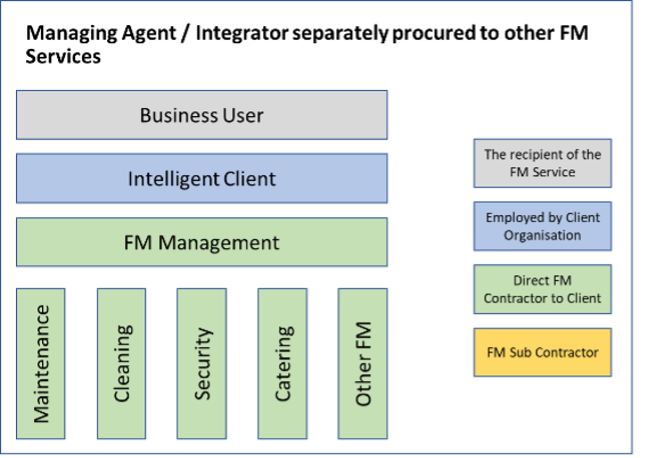

The final model included in this paper where management is outsourced is a managing agent / integrator model (See Figure 5). This is where the client has separate contracts directly with the management company and the FM supply chain. Typically, organisations that would otherwise sub-contract services such as Mace Macro and Cushman & Wakefield would be the type of organisations that would deliver this model. Those organisations that pre-dominantly self-deliver would be unlikely to want to deliver this type of model unless the scale of the management service is very large. For example, Sodexo were appointed to provide an integrator service for a large Government Department.

The following models are where the FM Management is retained by the Client Organisation.

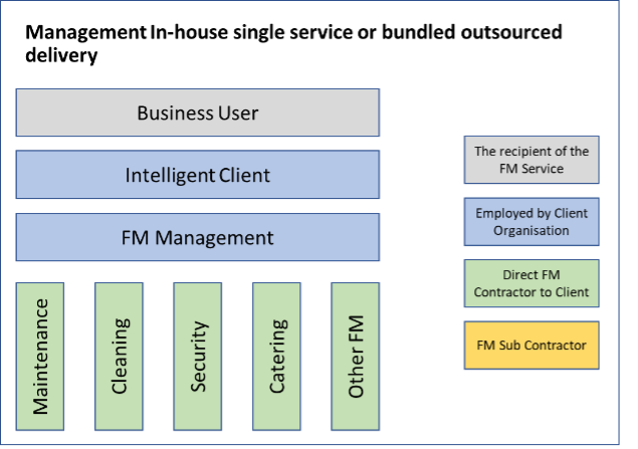

In the following model (See Figure 6) the client employs specialist service providers for each of the main FM services. In this type of model the Client will need to have appropriate FM systems in place to ensure that management information can be combined in a consistent way to understand and manage overall performance.

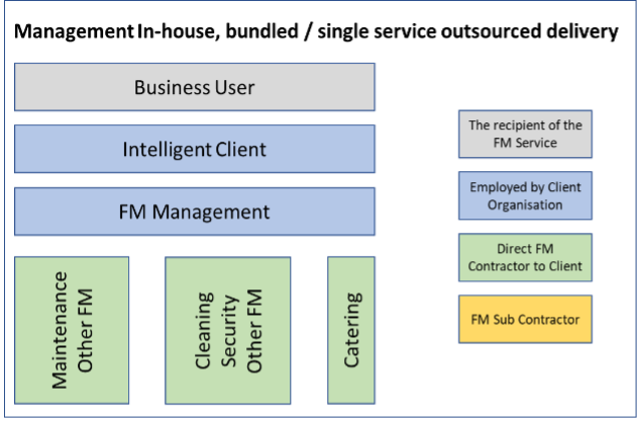

Sometimes clients may believe that bundling services will benefit their delivery model (See Figure 7). For example, one organisation combined security with first response maintenance because each location needed security guards but their security role was not sufficient to keep them busy all of the time. Equally the diverse geography of the estate meant that the maintenance response time for minor issues would mean the business requirement was not met. In this case the solution bundled security and maintenance with the same supplier.

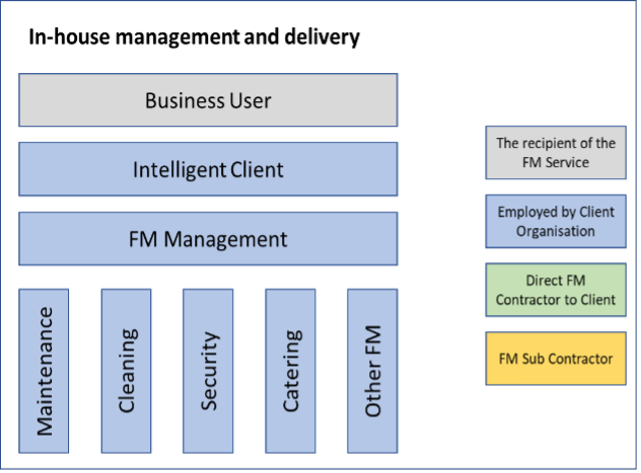

It is rare to have all FM services delivered by the client organisation (See Figure 8) if only because most organisations see it as something that is not core to their main service and do not want to invest money in systems, people and plant to ensure that they have a service that is as efficiently and effectively delivered as the FM market. An exception is the Higher Education estate which is often perceived to be core to their offer and also the FM market has the disadvantage of the client having to pay VAT if the market delivers the service and not having to pay VAT if it is delivered by the University.

Role of intelligent client

In each of the models above is a separate Intelligent Client role. This is an important role for any organisation and by definition needs to be independent of the outsourced suppliers and very knowledgeable of the occupier’s business. In some cases this has been outsourced to specialist consultants but in the main is a function provided by the client itself.

A helpful description of the role is included in the “Office of Government Commerce Principles of Contract Management: Service Delivery” which identifies that the Intelligent customer capability needs to combine “in-depth knowledge of the (client) business and understanding of what the provider can and cannot do. It is vital that the individuals or teams responsible for managing contracts on the customer side have this kind of capability. The aim is to reduce misunderstanding between customer and provider and to avoid problems, issues and mistakes before they happen.”

We believe a strong Intelligent Client role is important, as clients should not abdicate responsibility to collaborate with supplier to deliver the service. Just outsourcing a service does not provide the “business” guidance that is necessary for a successful contract.

In Conclusion

The FM market is mature and flexible enough to support a wide range of client requirements. However, it should be understood that all suppliers will have their limitations as far as geography or services or commercial risk etc. There are a number of different models that Buyer’s can procure and it is important for the Buyer to understand the most relevant for them. The next Blog in the series considers. What Buyers should consider when sourcing FM services.

Leave a reply